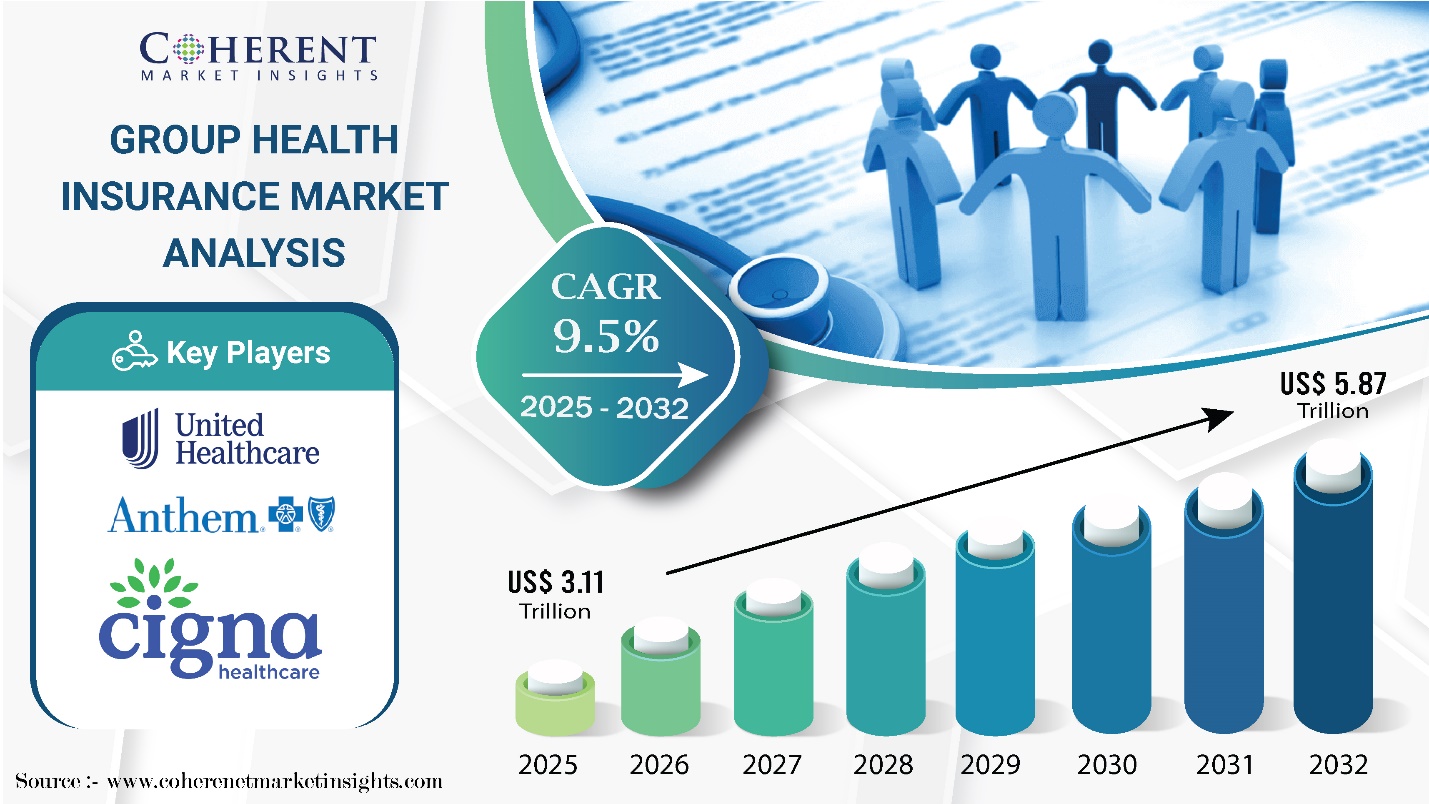

Group Health Insurance Market Size to Hit USD 5.87 Tillion by 2032, says Coherent Market Insights

Burlingame, CA, Nov. 12, 2025 (GLOBE NEWSWIRE) -- The Global Group Health Insurance Market is estimated to be valued at USD 3.11 Tn in 2025 and is expected to reach USD 5.87 Tn by 2032, exhibiting a compound annual growth rate (CAGR) of 9.5% from 2025 to 2032. This strong growth is fueled by a growing corporate emphasis on employee well-being, escalating healthcare costs, and expanding insurance coverage across emerging markets, driving significant demand for comprehensive group health insurance solutions globally.

Request Sample Report: https://www.coherentmarketinsights.com/insight/request-sample/8519

Global Group Health Insurance Market Key Takeaways

Demand is anticipated to remain high for self-funded (employer-sponsored) plans, with the target segment accounting for a market share of 64.5% in 2025.

Based on plan type, health maintenance organization (HMO) segment is slated to account for more than one-fourth of the global group health insurance market share by 2025.

As per CMI’s new group health insurance market forecast, inpatient coverage segment is expected to hold a prominent market share of 32.2% in 2025.

North America is slated to retain its dominance, accounting for nearly two-fifths of the global market share in 2025.

Asia Pacific, with an estimated share of 24.5% in 2025, is poised to emerge as the most lucrative market for group health insurance during the assessment period.

Increasing Healthcare Costs Fueling Market Growth

Coherent Market Insights’ latest group health insurance market analysis outlines major factors driving growth. One such prominent growth driver is the rising healthcare costs.

Expenditures for hospitalization, diagnostics, medicines, and surgeries are increasing significantly worldwide. This is where group health insurance comes in handy, offering employees and employers financial protection against unexpected medical expenses.

Moreover, modern consumers are increasingly becoming aware of the need for health insurance to mitigate financial risks associated with illnesses as well as accidents. This combination of rising healthcare costs and growing awareness of financial protection is expected to boost growth of the group health insurance market during the forecast period.

Immediate Delivery Available | Buy This Premium Research Report: https://www.coherentmarketinsights.com/insight/buy-now/8519

Lack of Awareness and High Premium Costs Limiting Market Growth

The global group health insurance market outlook remains optimistic. However, limited public awareness and high premium costs may limit market growth to some extent during the assessment period.

Rising healthcare expenses lead to higher insurance premiums, making it costly for small and medium enterprises (SMEs) to offer group health insurance. This financial barrier could slow down group health insurance market growth in the coming years.

In addition, many small organizations and employees remain unaware of the benefits of group health insurance. This lack of awareness further limits adoption, potentially reducing overall group health insurance market demand.

Increasing Incidence of Chronic Diseases Unlocking Growth Opportunities

The global prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer is increasing rapidly. This surge is fueling demand for long-term care, specialized treatments, and preventive healthcare services, thereby driving the adoption of health insurance. Consequently, the rising incidence of chronic conditions is expected to create lucrative growth opportunities for group health insurance companies during the forecast period.

Emerging Group Health Insurance Market Trends

Rising interest in preventive healthcare is a key growth-shaping trend in the group health insurance market. Insurers are increasingly incorporating wellness programs that incentivize healthy behaviors, such as regular health screenings, fitness challenges, and chronic disease management initiatives. These programs encourage proactive health management, helping shift the focus from reactive treatment to preventive care.

Customization trend is gaining traction in the group health insurance industry. Many group health insurance providers now offer personalized plans tailored to different employees and lifestyle preferences.

Digital transformation, including usage of telemedicine, digital claims processing, and AI-driven underwriting, is reshaping group health insurance. Likewise, insurtech innovations are revolutionizing the traditional group health insurance landscape by enhancing efficiency, personalization, and customer experience.

Request For Customization: https://www.coherentmarketinsights.com/insight/request-customization/8519

Analyst’s View

“The global group health insurance industry is expected to record strong growth, owing to rising prevalence of chronic diseases, increasing healthcare costs, ongoing digital transformation, regulatory support, and escalating awareness about the importance of financial protection against medical emergencies,” said a lead CMI analyst.

Current Events and Their Impact on the Group Health Insurance Market

| Event | Description and Impact |

| Post-COVID Healthcare System Transformation |

|

| U.S. Healthcare Policy and Regulatory Changes |

|

| Technological Disruption |

|

Competitor Insights

Key companies in the group health insurance market report:

- UnitedHealth Group

- Aetna (CVS Health)

- Anthem (Elevance Health)

- Cigna

- Kaiser Permanente

- Humana

- AXA SA

- Allianz SE

- Aviva plc

- Zurich Insurance Group

- Blue Cross Blue Shield Association

- MetLife Inc.

- Bupa

- Manulife Financial Corporation

- Prudential Financial Inc.

Key Developments

In October 2025, UnitedHealthcare introduced its 2026 Medicare Advantage plans. These plans are designed to help people handle growing healthcare costs and make insurance more affordable. They offer benefits that are meant to meet the changing needs of Medicare members.

In November 2024, AXA - Global Healthcare announced the launch of a new customizable product called Global Health Adapt. It is designed to meet the needs of SMEs with a globally based workforce. The plan offers flexible healthcare coverage that can change as the needs of SMEs and their workers evolve. It will be available for new customers from January 2025.

Market Segmentation

Insurance Type Insights (Revenue, USD Tn, 2020 - 2032)

- Self-Funded (Employer-Sponsored) Plans

- Fully Insured Plans

Plan Type Insights (Revenue, USD Tn, 2020 - 2032)

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- Point of Service (POS)

- High-Deductible Health Plans (HDHPs)

Coverage Type Insights (Revenue, USD Tn, 2020 - 2032)

- Inpatient Coverage

- Outpatient Coverage

- Dental and Vision Coverage

- Maternity and Newborn Care Coverage

- Prescription Drug Coverage

- Other (Mental Health and Wellness Coverage)

Coverage Option Insights (Revenue, USD Tn, 2020 - 2032)

- Individual Coverage (employee-only protection)

- Family Coverage (employee + dependents, such as spouse, children, parents)

Policy Duration Insights (Revenue, USD Tn, 2020 - 2032)

- Lifetime Coverage

- Term Insurance

Enterprise Size Insights (Revenue, USD Tn, 2020 - 2032)

- Small Enterprises

- Medium Enterprises

- Large Enterprises

Product Type Insights (Revenue, USD Tn, 2020 - 2032)

- Contributory Plans (Premiums shared by employer and employee)

- Non-Contributory Plans (Fully paid by employer)

Payor Insights (Revenue, USD Tn, 2020 - 2032)

- Private Insurers

- Public/Government Insurers

Distribution Channel Insights (Revenue, USD Tn, 2020 - 2032)

- Direct Sales (Insurers to Employers)

- Agents/Brokers

- Bancassurance

- Others (Online Platforms)

-

Regional Insights (Revenue, USD Tn, 2020 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- North America

Related Reports:

Healthcare Payer Services Market Size, Share & Trend Analysis Report (2025-2032)

Corporate Owned Life Insurance Market Size, Share, Trends & Opportunities for 2025-2032

Short Term Insurance Market Analysis for 2025-2032

Our Trusted Partners:

Worldwide Market Reports, Coherent MI, Stratagem Market Insights

Get Recent News:

https://www.coherentmarketinsights.com/news

About Us: Coherent Market Insights leads into data and analytics, audience measurement, consumer behaviors, and market trend analysis. From shorter dispatch to in-depth insights, CMI has exceled in offering research, analytics, and consumer-focused shifts for nearly a decade. With cutting-edge syndicated tools and custom-made research services, we empower businesses to move in the direction of growth. We are multifunctional in our work scope and have 450+ seasoned consultants, analysts, and researchers across 26+ industries spread out in 32+ countries. Contact Us: Mr. Shah Coherent Market Insights 533 Airport Boulevard, Suite 400, Burlingame, CA 94010, United States US: + 12524771362 UK: +442039578553 AUS: +61-8-7924-7805 India: +91-848-285-0837 Email: sales@coherentmarketinsights.com Website: https://www.coherentmarketinsights.com For Latest Update Follow Us: LinkedIn | Facebook | Twitter

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.